- Our Offer

- Your investment opportunities

- Plan B & Emigrate

- News

- Panama

- Team

- Contact

Author: Klaus Happ

Mit der Kombination aus unserer jahrzehntelangen Finanzmarkt- und Immobilienerfahrung, der Kenntnis des Immobilienmarktes in Panama und den sehr guten Kontakten im Land biete ich unseren Kunden einen Rundum-Service für Immobilien in Panama.

Travelling in Panama in Corona Times / March 2021

What is it to travel in Panama in Corona times? What can you do during a long weekend in Panama. Klaus Happ talks about his experiences during his trip in Panama in March 2021 in his video. Just click on the video BELOW to learn more.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Corona Virus in Panama / Update 26 March 2021

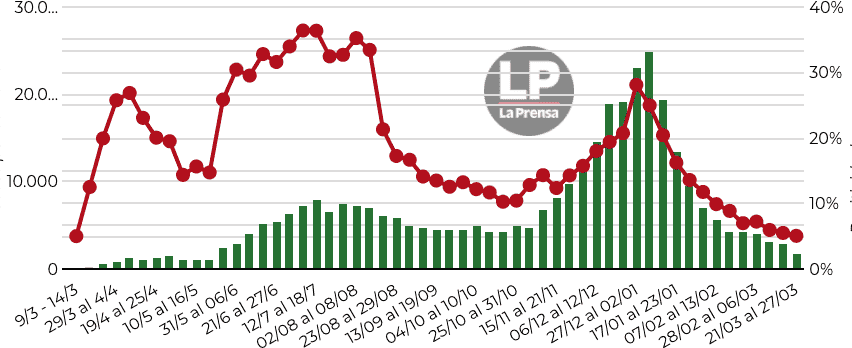

The Corona situation in Panama is currently good, as new infections have been falling steadily in recent weeks and are at a low level. All sectors of the economy are open. Below you will also find more information on Corona vaccination in Panama.

Health (figures as of 25 March 2021)

- There are currently 5.030 active cases.

- The R-value is 0,91

- The mortality rate is 1.7% (global average 2.2%)

- Panama performs the same number of tests per capita as Germany.

- The percentage of positive tests is currently below 5% daily.

- The intensive care beds have never been fully utilized.

- Corona vaccination started in Panama in January.

- The goal is to have 84% of the population vaccinated by the end of the year. The current figure is 8%.

- 5.2 million doses have been ordered (Biontech/Pfizer, AstraZeneca, Jonson & Johnson) and negotiations are underway for an additional 3 million doses of Sputnik V vaccine.

- Since Panama has a very young population (Ø 26 years), people aged 60 and over were already vaccinated in phase 1.

- So far, 8,5% of the Panamanian population has been infected with Corona. Taking into account the estimated number of unreported cases, this figure should be about 20%, which is much closer to herd immunity.

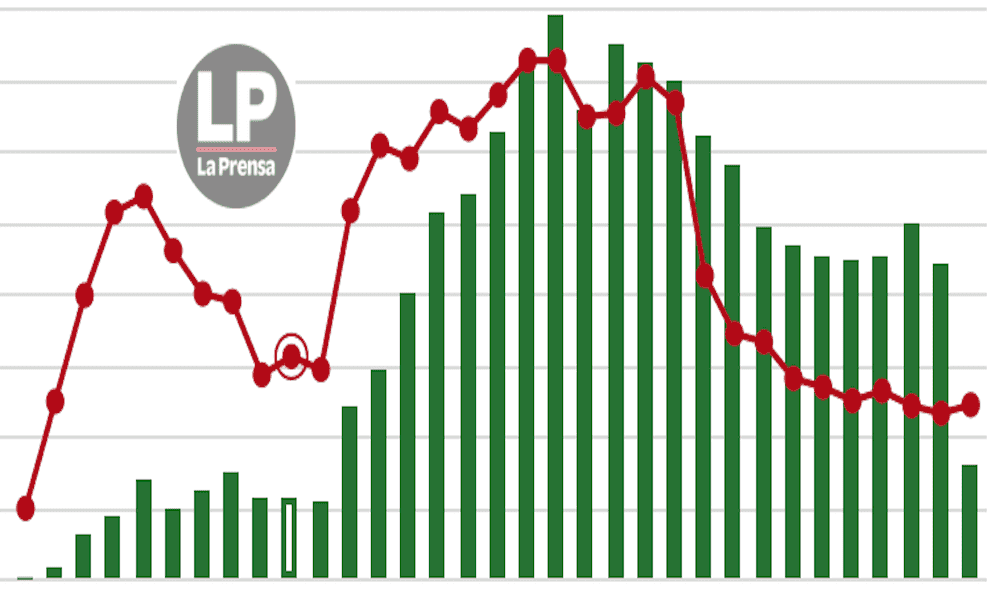

- The graph shows the weekly trend (March 20 – March 21) of new infections (bars) and the test positive rate (curve). The sharp increase in June began with the economic opening. The increase in November is due to the holidays in early November (data link).

Economy

- All sectors of the economy are open.

- Restaurants and stores are allowed to open until 10.00 p.m., although many restaurants, hotels and stores are still closed.

- The support payment for socially weak people is 120 USD per month. As unemployment has skyrocketed, this amount is barely enough for many poorer families.

- Current estimates predict economic growth of +9,9% in 2021 (2020: -17%).

Life in Panama

- The government measures the corona risk of the individual regions on the basis of certain indicators (R-value, hospital occupancy rate, etc.) and adopts region-specific measures on the basis of this.

- Throughout Panama there is currently a curfew from 11.00pm – 04.00am daily and in the greater Panama City area additionally on weekends.

- Beaches are open from 06.00am – 06.00pm.

Travel to Panama

- Since 12 October 2020 Panama Citys International Airport is open again.

- Visitors (regardless of where they come from in the world) must present a Corona negative test (max. 48 hours old) or alternatively take a rapid test at the airport in Panama. If the test is positive, you will be quarantined in Panama.

- Departing travelers can take a Corona test at Panama City Airport (if required by their home country).

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

“Golden Investor Visa” in Panama

The new “Golden Investor Visa” in Panama allows investors to apply for their second residence from abroad and receive it after just 30 days. This visa type requires an investment e.g. in real estate of at least 300,000 USD (from October 2022 it will be 500,000 USD) and a holding period of at least five years. All existing visa types in Panama will continue to exist and after 5 years you can apply for your Panama passport and citizenship. However, there are plans to make the Friendly Nations visa more difficult. This is the easiest form so far. Click on the link to find our “Visa & Invest Factsheet” with all information.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

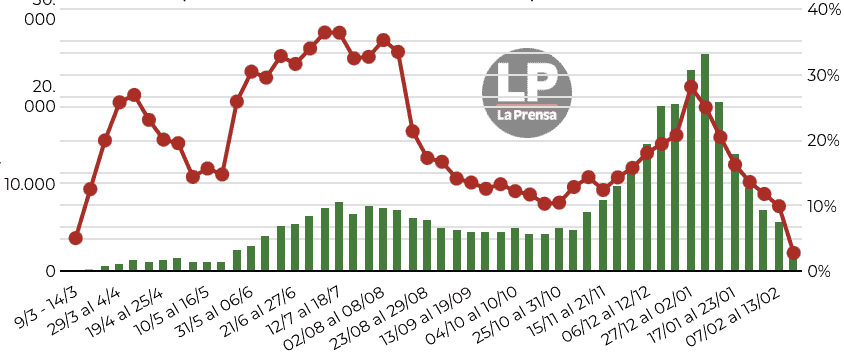

Corona Virus in Panama / Update 16 February 2021

The case numbers for Corona virus in Panama have improved significantly since mid-January and as a result, most of the partial lockdown implemented in December has been lifted. Below you will also find more information on Corona vaccination in Panama.

Health (figures as of 16 Feb 2021)

- There are currently 333.251 cases and 5.655 deaths.

- The R-value is 0,83

- The mortality rate is 1.7% (global average 2.2%)

- Panama performed more tests per capita in 2021 than Germany.

- The percentage of positive tests is currently 7-10% daily.

- The intensive care beds have never been fully utilized.

- Corona vaccination started in Panama in January.

- 5.2 million doses have been ordered (Biontech/Pfizer, AstraZeneca, Jonson & Johnson) and negotiations are underway for an additional 3 million doses of Sputnik V vaccine, covering 80% of the population.

- By the end of March, 750,000 doses are expected to arrive in Panama.

- In phase 1, hospital staff will be vaccinated. Since Panama has a very young population (Ø 26 years), people over 60 years of age will also be vaccinated in phase 1.

- So far, 8% of the Panamanian population has been infected with Corona. Taking into account the estimated number of unreported cases, this figure should be about 20%, which is much closer to herd immunity.

- The graph shows the weekly trend (Mar 20 – Feb 21) of new infections (bars) and the test positive rate (curve). The sharp increase in June began with the economic opening. The increase in November is due to the holidays in early November (data link).

Economy

- Almost all sectors of the economy are open.

- Restaurants and stores are allowed to open until 9 p.m., although many restaurants, hotels and stores are still closed.

- The support payment for socially weak people is 120 USD per month. As unemployment has skyrocketed, this amount is barely enough for many poorer families.

- Current estimates predict economic growth of -9.% in 2020 (2021: +5%) and an unemployment rate of 18.5%.

Life in Panama

- The government measures the corona risk of the individual regions on the basis of certain indicators (R-value, hospital occupancy rate, etc.) and adopts region-specific measures on the basis of this.

- Throughout Panama there is currently an curfew of 10.00pm – 04.00am daily and in the greater Panama City area additionally on weekends.

- In some regions the beaches are completely open, in others only on weekdays.

- Violations of the Corona measures are punished since December 3 with cancellation of the Corona aid for the persons concerned.

Travel to Panama

- Since 12 October 2020 Panama Citys International Airport is open again.

- Visitors (regardless of where they come from in the world) must present a Corona negative test (max. 48 hours old) or alternatively take a rapid test at the airport in Panama. If the test is positive, you will be quarantined in Panama.

- Departing travelers can take a Corona test at Panama City Airport (if required by their home country).

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

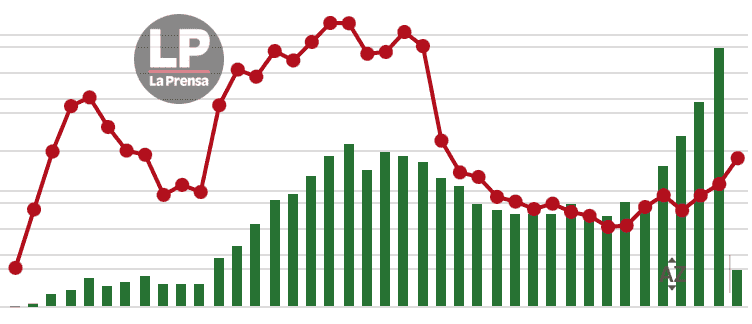

Corona Virus in Panama / Update 09. Dezember 2020

Corona figures in Panama had improved significantly from August to November, so that all economic sectors and tourism in Panama are open again. I have summarized my impressions during my November trip in this VIDEO (link to click). At the beginning of November, the national holidays led to an increase in private parties, which has resulted in higher case numbers since the end of November. However, Panama currently performs more tests per capita per day than e.g. Germany, which explains part of the increased case numbers.

Health (figures as of 07 Dec 2020)

- There are currently 179,230 cases and 3,212 deaths.

- The R-value is 1.18

- The mortality rate is 1.79% (global average 2.29%)

- After the USA (world leader), Panama carries out the most tests per capita on the American continent.

- The percentage of positive tests was around 10% at the beginning of November and currently fluctuates daily between 14 – 19%.

- The intensive care beds have never been fully utilized.

- In Panama, Pfizer / Biontech vaccines are expected to be available in Q1 2021. In addition, vaccine doses have also been ordered from AstraZeneca. Basically, the population of Panama is vaccine tolerant.

- The graph shows the weekly development (March – December) of new infections (bars) and the test positive rate (curve). The strong increase in June began with the opening of the first economic sectors. The increase at the end of November is due to the public holidays at the beginning of November and the immense increase in the number of tests performed daily (data link).

Economy

- All economic sectors are reopened.

- After the Panama Canal ended its fiscal year (30/09) with a turnover increase of 1.2%, the last turnover reports of the Canal Authority are also positive. In particular, business with Asian trading partners has picked up strongly again.

- Many restaurants, hotels and stores have not yet reopened.

- Current estimates assume economic growth of -9.3% in 2021 (2021: +6.4% / 2022: +5.1%) and an unemployment rate of 13.9% (2021: 9.8% / 2022: 8%) (Info-Link).

Life in Panama

- The government in Panama has introduced a “traffic light system” for the different districts of Panama, which shows the current level of risk. Different restrictive measures are then associated with the respective color. The risk is measured by the R-value, the mortality rate and the utilization of intensive care and hospital beds (info link).

- Since December 03, violations of the corona regulations have been punished by cancellation of the corona aids for the persons involved.

- In the greater Panama City area, for example, there is currently an curfew from 09.00pm – 05.00am and a prohibition of alcohol during this time.

Travel to Panama

- Panama has received the “Safe Travel Country” certificate from the “World Travel & Tourism Council” due to the corona measures introduced (info link).

- Since 12.10. the international airport of Panama City is open again.

- Travellers (no matter from where in the world) have to present a Corona negative test (max. 48 hours old) or alternatively make a quick test (results after 20 min) at the airport in Panama for 50 USD. If this test is positive, the person will be quarantined in Panama.

- Beaches and other tourist facilities are open.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Panama City Real Estate Market Report 2020 / 2021

Our report on the real estate market in Panama City 2020 / 2021 describes the trend of the real estate market in the exceptional Corona year 2020 and takes a look at Panama’s real estate in 2021. As in the previous year (Report 2019 / 2020) we only report about high quality real estate in prime locations in Panama City, which are located in the UNESCO Old Town “Casco Viejo”, in the promenade street “Avenida Balboa”, in Punta Pacifica and on Ocean Reef. Because these are the locations in which we are active ourselves and can report on prices & rents realized by us.

Those who wish can use the following link to learn about the main events and the historical real estate market trends in Panama City over the last decades.

Anyone who has ever been to Panama City will have noticed that the skyline and thus the supply of residential real estate is huge. That is why we have always focused on unique, hard to duplicate locations with good quality. These are stable in value and easy to let.

The year 2020 had started very well for the real estate market and the economy of Panama. The new Panamanian government had only been in office for six months and new major projects were in the starting blocks (including the city beach Panama City, the fourth bridge over the Panama Canal, the third metro line, and the new cruise ship terminal). In addition, Panama’s copper mine had just gone into operation and the old town “Casco Viejo” was full of large groups of tourists.

And then the corona virus came to Panama…and everything was stopped.

The Panamanian government took a strict course against the virus from the beginning and implemented a hard lockdown of the country from mid-March on. This lockdown was gradually relaxed from mid-June and finally ended on October 12th with the opening of the international airport and tourism.

- Due to the month-long lockdown, which also applied to the real estate industry, there were hardly any sales during this period that could be used to determine a trend for prices.

- Since the beginning of October, furniture stores have been well visited again and many are sold out. Confidence is back.

- However, the Corona-related higher unemployment in Panama will probably affect prices and rents of C and D properties (lower quality locations).

- B properties (medium to good locations & qualities) have proven to be quite crisis resistant in terms of both prices and rents.

- Prices in prime locations in Panama City are at about the same level as before. Owners are not willing to sell at really lower prices. Of course, there are always exceptions, but a trend cannot be seen.

- At the same time, the Corona credit moratorium was recently extended until June 2021, which is why credit-financed real estate is not under stress. In general, the credit share of real estate in Panama is quite low, which makes it less vulnerable to crises.

- Many expats (employees of multinational companies / tenants for A-locations) had temporarily returned to their home countries during the Panama lockdown. During the lockdown it was difficult to find new tenants and to arrange viewings. Therefore, rents for new leases for A-locations have fallen 10-15%. Expats have been returning to Panama since the reopening of the airport in October, which is again supporting rental demand and is already noticeable.

- Since October we have also been seeing international buyers in Panama again. These come from Europe and we ourselves are seeing, for example, increased demand from German-speaking Europe for applying for second residences in Panama and opening bank accounts.

- In addition, our real estate partners in Panama are reporting increased interest since the reopening of the airport from wealthy people from South America (including Argentina, Chile and Colombia) who, due to various crises in their home countries (often accelerated by the Corona crisis), consider USD real estate in Panama as a “safe haven”. The Bloomberg report (info link) published a few months ago, which reports on the escapes of millionaires from the countries of South America to Panama and other interesting locations, also fits in with this.

- Panama is regionally in a very good position for a strong recovery in 2021. The recovery will be slow, but has already begun. And as long as Panama remains a stable and safe country due to its international importance, this recovery is likely to occur much faster than in other parts of Latin America

- The above mentioned mega infrastructure projects will bring new labor force and thus rental demand to Panama.

- We continue to buy real estate in Panama City in a prime location in the first row by the sea at approx. 2,300 – 2,500 USD / sqm and rent it out furnished in Corona times at approx. 12 – 14 USD / sqm (previously 14 – 15 USD). If the rental market remains at the lower level for a longer period of time, purchase prices will probably also be adjusted accordingly.

- The purchase of smaller apartments (40-70 sqm) in A-locations can be interesting in times of crisis, because the rental budgets are in general smaller. These are also available in buildings with CoWorking areas (Offer-Link).

- At the same time 2-bedroom apartments keep their attractiveness, because you can integrate your home office very easily.

- An increased demand is currently experienced by beach apartments near Panama City, because you can also work from there in your home office (info link).

However, Corona also offers opportunities.

With the island project “Ocean Reef” (info-link) they offer buyers among other things guaranteed USD rental income of 6% annually after costs. Even during the Corona Lockdown, many properties were bought here even before construction began, since people feel more relaxed on the islands than in the city center. “Ocean Reef” is the most successful real estate project in Panama City. The quality and location of this island property is unique in Latin America, as it is located directly in front of the center of Panama City, but due to the island location, one can enjoy its tranquility.

Also in the UNESCO old town “Casco Viejo” (Info Link) the purchase prices remained approximately on the level before Corona. For used properties in good locations you pay about 3.000 – 3.500 USD per square meter. The renovation works in the old town are running at full capacity again and new beautifully restored colonial buildings are being built. However, many stores and hotels that depend on tourism are still closed and this affects the attractiveness of the old town. Nevertheless, the Corona pandemic has also brought an advantage here. Because in the old town, whose narrow streets are often congested with cars, certain streets are now closed off at set times so that restaurants can use the beautiful streets for their tables.

Basically, the Casco Viejo is a very unique and stable value real estate location, since the approximately 850 buildings on the peninsula in front of the skyline cannot be duplicated.

The plan for an city beach in Panama City, which was initiated last year and would have significantly increased the attractiveness of the entire city, is not being realized at the moment. Instead, a viaduct bridge road will be built to connect the promenade road of Panama City with the Causeway (Pacific Island Road in front of the city).

Panama serves as a “safe USD haven” for investors and companies in Central and South America. Current crisis in the neighboring South American countries reinforce this effect. Exactly for such wealthy investors from South America, Panama has created a new investor visa, which promotes foreign direct investments in Panama and at the same time grants a residence permit under certain conditions. Whoever wants to invest in the region of Latin America will not be able to ignore the Panama location in his considerations right now.

As in the past, Panama’s objective is therefore to emerge from the crisis better than its neighbors and to remain the more attractive and safer country for investors.

And in times when there are political and regulatory developments in Europe and the USA that do not appeal to every investor, Panama will continue to be an attractive location for asset diversification. We are also happy to assist you in applying for a second residence in Panama (info link).

Property prices in Panama City (A-locations) have historically often followed the trends in the USA (e.g. Miami) and these have risen strongly this year. During the Panama-Lockdown this was not possible, so there is a certain need to catch up.

Although the purchase prices for 1A real estate in Panama City are roughly at pre-Corona level, I advise every buyer to negotiate the seller’s price nevertheless. If you don’t need a loan, but can pay directly with equity, you have a very good basis for negotiation. We are happy to help with our experience in this context.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Panama in Corona times / Trip Nov 2020

How is life in Panama during the Corona Pandemic? What has changed in Panama due to the Corona crisis? Klaus Happ reports about his experiences during his trip to Panama in November 2020. Click on the Panama video below to learn more about the current Corona situation in Panama and to see if a Panama trip in Corona times is worth the effort.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Corona virus in Panama / update 29 October 2020

The streets of Panama City are noisy again, which is a good indicator for the recovering economy of Panama. The international airport has been reopened for tourism, all economic sectors are on the rise and the spirit among the population has improved. This is due to the extensive opening after the months-long lockdown in Panama and the improving corona figures. The second corona wave is declining and a German vaccine is already being tested on first patients in Panama.

Health (figures as of 27 October 2020)

- There are currently 130.422 cases and 2.650 deaths.

- The R-value is 0.92 and has fallen continuously in recent weeks.

- The mortality rate is 2.0% (global average 2,7%).

- Currently, 80% of the test capacity of Germany is performed per capita.

- The percentage of positive tests has fallen from 35% (July) to currently about 10%.

- The intensive care beds have never been fully occupied.

- Curevac from Germany is testing its corona vaccine in Panama.

- The graph shows the weekly development of new infections and the test positive rate (curve). The strong increase in June began with the opening of the first economic sectors.

Economy

- All economic sectors are reopened.

- Consumer confidence is rising, as shown by a survey of the chambers of commerce.

- According to the government there will be no tax increases due to the Corona pandemic. This distinguishes Panama from many neighboring countries where many millionaires leave their homes to move to locations like Panama and protect their assets (info link to the Bloomberg report). New investor visas are offered for this purpose.

- The Panama Canal ended its fiscal year (September 30) with a 1.2% increase in turnover compared to the previous year. For the new fiscal year, a decrease in sales of 10% is expected. The better than expected developing economies of the USA and China give hope for a faster recovery. Thanks to water saving measures and rainfall, the canal has reached its highest water level again.

- A new multi-billion-dollar water project on the Panama Canal, the construction of the Metro Line 3 and four other major investment projects for public works are expected to boost the economy again.

- The copper mine, one of the largest worldwide, is running at full production (info link).

- According to the World Bank, Panama’s economy will shrink by 8.1% in 2020 and recover by 5.3% in 2021. In 2020, unemployment may rise up to 20 – 25% in the short term (in 2019: 7%).

Life in Panama

- Currently there is only a curfew from 11.00pm – 05.00am.

Travel to Panama

- Since 12.10. the international airport of Panama City is open again.

- 80 flights to 36 cities and 20 countries are operated daily.

- Travellers must present a corona negative test (max. 48 hours old) or can take a quick test (results after 20-30min) for 50 USD directly at the airport in Panama. If this test is positive, the person will be quarantined in Panama.

- According to current surveys (125 hotels) 36% of the hotels will reopen in October and another 32% by the end of the year. The rest would like to reopen in the new year and 1 hotel will close permanently.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama