- Our Offer

- Your investment opportunities

- Plan B & Emigrate

- News

- Panama

- Team

- Contact

Category: Real Estate

Why Panama?

Investors and entrepreneurs frequently ask me why they should invest in Panama. The background to this question is often that people don’t know much about this small country at the Panama Canal and that they have concentrated on their home market. And this although there is much competition and falling yields. In this article, I will look at the reasons why our investors invested in Panama. The main reason for them is often “diversification outside the euro zone”. This involves both investments in entrepreneurial projects and real estate in Panama.

(All info links with blue background are clickable)

Most people know exactly three things about Panama. Namely the Panama Canal, the story “Oh, how beautiful is Panama” and the Panama Papers. All three have something to do with Panama, but Panama is much more important for the world economy and has much more to offer investors.

Diversification

The economy, the real estate market and the stock market have performed well since the end of the financial market crisis in 2009. Especially the German market. This was the reason for many investors and entrepreneurs to concentrate on the domestic market, as yields were correspondingly attractive. For some time now, however, yields on German government bonds and first-class real estate have tended towards zero, and the stock market has also become more volatile in recent months. If you consider the weak growth forecasts of the European economy and the problems of individual European countries (Italy, France, Brexit, etc.), this is quite logical. In general, our investors all have a common reason for investing in Panama: Diversification outside the Eurozone. This involves the diversification of assets, the entrepreneurial portfolio and, in some cases, the life plan. Some of our investors no longer feel comfortable in Europe and are therefore establishing a Plan B. This means that they obtain a residence permit for Panama with our help and then often buy a property that can be rented out and used later by themselves. Panama has the USD as its national currency and is a very interesting country due to its political and legal security, which is why more than 250 multinational companies are based in Panama and most of them even have their headquarters for Central and South America. Companies such as Nestle, Adidas or the United Nations have done their country research and ultimately decided in favor of Panama. Under the following link you will find a good report on “Diversification”.

Diversification always makes sense, especially in politically and economically uncertain times. The only investor who should not diversify is the one who is always 100% on the right track! (John M. Templeton)

Yields

In Panama City in the prime locations the gross rental yields are approx. 6-7% p.a.

Modern apartments in Panama City on the Pacific Promenade are priced at approx. 2,500 USD per square meter and are rented at approx. 15 USD per square meter. Here you have an amazing view of the Pacific, the islands and the old town. This unique location naturally also applies to the historic UNESCO Old Town. In both parts of the city, the multinational corporations are looking for rental apartments for their employees so that you can achieve regular and attractive rental returns in USD. Population growth and average age are important aspects of investment, as both have a major impact on future purchasing power and demand. In Panama, population growth is about 2% p.a. and the average age is 26 years, which is very positive compared to Germany (0.2% / 44 years). The following links provide an overview of yields on international real estate markets and historical price trends.

Economy

- One of the fastest growing countries in the world

(GDP growth since 2002 approx. 8% p.a. average / IMF forecast 6% p.a. for the next 4 years) - Local currency is the USD

- There are 250 multinational companies in Panama; most of them have their Latin American Headquarters (e.g. Nestle, Roche, Adidas, DHL, but also the United Nations)

- Second largest free trade zone in the world

- Government debt is very low at 38% of GDP (vs. 86% in the euro zone)

- Panama’s economy is shaped by the service sector (about 75% of GDP) and benefits strongly from the mega infrastructure projects and the Panama Canal, which has another record year.

- In May 2019, the IMF reports on Panama’s economic quantum leap

- S&P raised Panama’s rating from BBB to BBB+ in April 2019

- Key economic figures for Panama

Politics

Panama is a democratic country where elections are held every five years and is considered politically stable. That is one of the reasons why international investors and companies have decided to invest here, because “an investment is only as safe as its country”. On 05 May 2019 the presidential elections took place in Panama. These elections have a big influence on the start of new major projects in Panama and are therefore very important for companies that are interested in doing business in Panama. Panama has made great efforts in recent years in the fight against money laundering and enacted various laws, so that Panama no longer appears on a black list. The European Union recently even decided to establish its diplomatic headquarters in Panama City.

Safety and security

Life in Panama is usually safe and normally you won’t get in touch with crime because Panama is considered the safest country in Latin America. This is also an important reason for the large corporations mentioned, because for them it is important that their thousands of employees feel safe in Panama. The following is still relevant in connection with security in Panama:

- Panama does not have its own military, because the USA protects the borders of Panama.

- Panama’s constitution protects private property for both domestic and foreigners

- The land register of Panama and the purchase procedure are very similar to the procedure in Germany.

- There are no hurricanes and no major earthquakes.

Life

In 2019, the company “International Living” once again voted Panama the best country in the world when it comes to the question of where to retire. They justify it with the unique combination of natural beauty, climate, standard of living, medical care and safety, which no other country has to offer in its entirety. In Panama City you will find hospitals at a high international level, as many doctors have been trained in the USA. You can find the full report at this link.

Besides all the advantages there are of course a lot of things that Panama should do better. These can be found in the previous link.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Real Estate Market Report Panama 2018 / 2019

This “Real Estate Market Report Panama” gives an overview about the development of the last years and describes the current situation. In 2010 I started to focus on the real estate market in Panama and then in 2013 I made my first real estate purchase. After years of research and network building in Panama, my own real estate company “FRAPAN-Invest” started operations in April 2017 and at the beginning of 2018 we started together with “arsago Real Estate” to build up a real estate portfolio (link). In the meantime, we have successfully completed various property purchases and also manage the properties.

To understand Panama and the real estate market in particular, I start with the main events in Panama in the last century:

- 1903 / Panama declares itself independent of Greater Colombia with the help of the USA. At the same time Panama adopts the USD as its currency and the construction of the Panama Canal by the USA begins

- 1914 / Completion of the Panama Canal

The basis for a solid and sustainable economy was set by the introduction of the USD and the construction of the Panama Canal.

- 1977 / US President Carter and Panama General Torrijos agree that the Panama Canal and the entire Canal Zone will revert to Panamanian sovereignty and control

- 1989 / The USA deprived dictator Noriega of power and Panama decided in the referendum to surrender its own military and to place itself from now on under the protection of the USA

- 2000 / The USA hand over the Panama Canal to Panama and all associated rights and assets

Panama was established in 1903. However, the country was “reborn” after the takeover of the Panama Canal on New Year’s Eve 1999 / 2000. Because now the country was additionally entitled to the income from the Panama Canal and the new opportunities resulting from it. In the first three years, investors still held back, because they wanted to wait for the development of the “new” Panama.

Panama already had a considerable skyline before. But starting in 2003, a real estate and construction boom began, as a result of which a large part of today’s known skyline Panama City was created.

- Early 2000s / Establishment of the Real Estate Tax Law, which states that all properties completed by 31.12.2011 remain exempt from property tax for 20 years

- 2003 – 2008 / Construction boom and massive rise in real estate prices. Real estate investors from North and South America invest in Panama. Increase in prime locations (Panama City, apartment, ocean front) up to 3,000 USD / sqm

- 2008 – 2011 / Decline in real estate prices due to the international financial crisis and the oversupply of real estate to prices in the low of approx. 2,300 USD / sqm for prime locations. Due to the conservative business policy, Panama’s banks will not experience a crisis during the financial crisis, as they are not invested in “US subprime”.

- 2012 – 2016 / Recovery of real estate prices to 2,700 USD / sqm in 1A locations.

April 2016 / The scandal of the “Panama Papers” shakes the country’s reputation and arrests it with prejudice. Although the “Panama Papers” do not have a major impact on economic growth (IMF forecast remains at around 6% p.a. for the next few years), real estate investors are holding back for the time being - 2016 – today / Due to the Panama Papers and the completion of major real estate projects, prices tend to move sideways or slightly lower (currently approx. USD 2,300-2,500 / sqm). At the same time, banks are now also more restrictive in granting loans and opening accounts for foreigners, also in order to no longer appear on the OECD and EU blacklists

For real estate buyers and to build up our real estate portfolio, we currently find a buyer’s market in Panama which, with the right strategy, delivers very interesting yield figures. While most real estate locations in the world have to struggle with very high purchase prices and correspondingly weak rental yields, we buy in ocean front prime locations at approx. 2,300 – 2,500 USD / sqm and rent at approx. 15 USD / sqm. This enables us to achieve rental yields of approx. 7% (net approx. 5%) in USD in the fastest growing country in the western world.

Property developers are currently going through a challenging phase in Panama, as they are facing a weaker market with the completion of their projects. We are not currently buying from property developers, but are buying finished properties in attractive locations at lucrative prices. We select the locations and properties in which the employees of multinational corporations and international organizations are expected to rent and live. Panama City is the headquarters of 250 multinational corporations, half of which have their operational headquarters for Central and South America in Panama (Nestle, Roche, Adidas, Bayer, Total, P&G, etc). The third largest United Nations headquarters in the world is in Panama. It is from here that they manage their activities in Central and South America. These are our target tenants and also the current tenants of the purchased properties.

Rental prices have come back slightly in the last two years, but with approx. 15 USD / sqm in the prime locations are still very attractive. In Panama, people are waiting for new government-driven projects that will boost the economy, bring people to Panama and have a positive impact on the rental market. In Panama, the 5-year presidential elections will take place next year. Currently we are in the pre-election year, which historically is always a relatively weak economic year, as new projects are put on hold until the new government. This is how Latin America works…The IMF forecasts GDP growth for 2018 at “only” 4.6% after a 4-week strike by the construction union in May. According to the IMF, this will be made up in 2019 with growth of 6.8% and in the following years between 5.5% and 6%.

After diplomatic relations with China (Link) were closed in 2017, China is investing heavily in infrastructure in Panama. China has appointed Panama as its location for its silk road project due to its geographical location within Latin America and Air China has been flying to Panama twice a week since March 2018. What does this have to do with the real estate market? Because the Chinese are now allowed to travel to Panama with visa facilitation, they are now also acting as real estate buyers and through the infrastructure projects there are new jobs, which in turn generates rental demand.

Basically, Panama’s economy has to struggle with the following problems:

- Poor education system of the population

- Corruption

- Reputation as a tax haven, although Panama is no longer on the EU or OECD blacklist (Link)

Furthermore, a widening trade war between the US and China would affect the profitability of the Panama Canal.

Nevertheless, Panama’s economy is currently growing faster than most of the rest of the world and according to IMF forecasts, and the Panama Canal has closed the fiscal year with a record year (Link). These are important elements for the attractiveness of the investment location and the real estate in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Beach Apartments in Panama

If you are looking for a relaxing apartment at the beach with good infrastructure near the metropolis Panama City, Coronado is the place to be. Only one hour away from Panama City is Panama’s biggest and most developed beach area. On the beautiful beaches of Coronado you will find all necessary facilities of daily life like restaurants, supermarkets, nightlife and medical care. This makes you independent of the metropolis of Panama City, but still close enough to be able to dive into city life at any time.

The beach community Coronado originates in the 1970s. At that time, one of Panama’s wealthiest families built the first golf club in the area and in the following years expanded it to include a beach club. As a result, the first weekend homes in Coronado were built by families who live in Panama City but like to spend the weekend in their properties on the beach in Panama. As a result, there were the first restaurants, supermarkets, etc. in the area.

However, the real construction boom started in 2008, when one of the big Panamanian property developers came up with the idea of building the first large residential complex with apartments in Coronado, which met with great demand from North Americans especially.

There are four large supermarkets, several bars, a cinema, one hospital and much more, so you don’t have to leave for Panama City. The mountain range of Panama with the popular mountain village “El Valle de Antón” and always springlike temperatures is only 45 minutes away by car. The area is one of the driest and most sunny in Panama, so it is bathing season on 10 months a year.

In the Coronado area, there are about 15 such large residential complexes, three of which went bankrupt and were taken over by others. We prefer only three of these properties because of their location, quality, price, leisure facilities (pools, sports activities, restaurant, etc) and beach. In the last few years, the property market in this area has been characterized by slightly declining prices, as too much has been built. For apartments on the beach in Panama in good locations and qualities you pay about 2,500 USD/sqm in this area, which corresponds to the prices in Panama City. Maximum prices were paid in 2012 at just over 3,000 USD / sqm.

Unlike Panama City, renting by airbnb is allowed here, so you can rent out your apartment in Coronado at good yields. There is hardly any competition from hotels in this area with regard to rental. The rental period here is usually from the weekend up to six months. Tenants are people (locals and expats) who live in the city and spend their weekend and annual holidays here and tourists from Europe and North America. This area is particularly popular with North Americans, as flights to Panama from there are much cheaper than to the Caribbean. Furthermore, Panama is much cheaper and safer than most Caribbean countries.

No matter whether you want to use your apartment in Coronado yourself or as an investment property, we are happy to help you with your real estate in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

How to buy real estate in Panama

We have realised many different real estate purchases in Panama. With this article we would like to give you an overview of the most important steps when buying a property in Panama. Furthermore, you will find a description of the transaction costs in Panama.

Purchase Process in Panama:

Existing property

- Purchase offer and price agreement

- Reservation agreement (Usually digital signature, 15 working days, 1% deposit)

- Legal Due Diligence

- Technical inspection of the property

- Purchase contract (45-60 days closing, 10% deposit)

- Buyer: Application of an irrevocable letter of payment with his bank in Panama or provision of the money for a bank transfer of the final payment

- Seller: Pay relevant taxes & obtain water and electricity certificates

- Notary appointment and handing over of the payment cheque or bank transfer of the final payment

- Registration in the land register

- Cashing the payment cheque if you have not used a bank transfer

Property in a real estate development

- Purchase offer and price agreement

- Reservation (Usually digital signature / e.g. 2 weeks, 10,000 USD deposit)

- Legal due diligence

- Purchase contract (Usually digital signature, 10% – 30% down payment, depending on project)

- Remaining deposits (up to a total of 50%) according to construction progress

- Buyer: Application of an irrevocable letter of payment with his bank in Panama or provision of the money for a bank transfer of the final payment

- Seller: Completion of the property

- Notary appointment and handing over of the payment cheque or bank transfer of the final payment

- Registration in the land register

- Cashing of the payment cheque if you have not used a bank transfer

Once you have found your property, you can also complete the property purchase in Panama from home. Because you do not have to be in Panama for the above points, because you can do some of them online or with a power of attorney for your lawyer in Panama. Your lawyer will then represent you in the purchase process with a special power of attorney, which is best given to him during your trip to Panama. With the help of our partner lawyer you can open your bank account in Panama online. This bank account can also be crypto-friendly if you want. Take the help of our lawyers to ensure that everything runs smoothly.

We accompany you through the entire buying process in Panama.

Our experience shows that our efficient process takes us about 3 months from price agreement to registration in the land register.

We are more than happy to help you with our experience when buying a property in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Real estate portfolio & strategy in Panama

After “FRAPAN-Invest” and “arsago Real Estate” from Frankfurt established a partnership for real estate investments in Panama in July 2017, we started to build up a diversified and profitable real estate portfolio (Link) in Panama in January 2018, in which investors participate as limited partners.

With the following presentation we would like to present the real estate market in Panama, our strategy and our current real estate portfolio. By clicking on the link you will be taken to the corresponding presentation ( Link).

The real estate market in Panama counts internationally as one of the most interesting locations for property investment. We would like to be your local trusted adviser and to take care of your investments in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Property management in Panama City

Since April 2018, we offer to real estate owners property management in Panama City. This allows us to offer real estate investors an all-in service for their properties in Panama (consulting, brokerage, purchase processing, management and investor trips to Panama).

As part of our management of properties in Panama City, we offer the following services:

- AirBnb service (marketing, administration, customer care, cleaning, etc)

- Long-term rental

- Furnishing and turnkey solutions

- Support in finding tenants

- Organisation and supervision of necessary repairs

- Network of reliable tradesmen

- Coordination of air conditioning maintenance

- Coordination of access to public service providers (water, electricity, etc.)

- Control of incoming rent and expenses

- Inspections

- Participation in owners’ meetings

- Monthly reporting

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Investment in real estate portfolio

Investors participate in Panama real estate portfolio.

In July 2017 “FRAPAN-Invest” and “arsago Real Estate” from Frankfurt have entered into a partnership for real estate investments in Panama (Link). We combine decades of real estate management experience with local market access and network in Panama. Now investors are investing in a diversified and profitable real estate portfolio.

In December 2017, we began to build up a diversified and profitable real estate portfolio in Panama, in which investors as limited partners participate. This portfolio enables investors to achieve steady and attractive rental returns in USD.

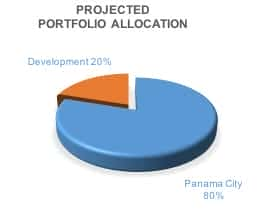

The planned allocation of the real estate portfolio in Panama is as follows:

We are currently buying in Panama’s prime locations, where employees of multinational corporations such as Nestle, Adidas, the United Nations (and another 250 multinational corporations in Panama) are looking for rentals. Our investments so far have focused on modern apartments in the skyline in the front row of the Pacific Ocean and on apartments in the unique UNESCO Old Town. The gross rental yields to be achieved in USD are around 7%.

Enclosed photos of a purchased UNESCO-Altstadt-Apartment (Link) and a purchased modern apartment (Link) to get an impression of our investments.

And this is the view of another apartment that we are about to buy:

When selecting apartments, we pay attention not only to finding reliable and long-term tenants, but also to the value of the properties and their locations. We are currently buying modern apartments in the first row on the Pacific Ocean for about 2,500 USD per square meter. At the current exchange rate this is approximately 2,000 euros per square meter. Such prices in comparable locations will be difficult to find in other parts of the world. Against this backdrop, we will continue to focus on achieving lucrative price increases in the future when selecting properties for sale.

The demand for apartments is currently increasing in Panama City. This applies to both buyers and tenants. On the one hand, this is due to the low purchasing costs compared with other countries and the weak USD. For example, many Canadian investors are currently using the strong CAD vs. USD for their purchases and want to buy before the arrival of Chinese investors (who will soon receive their tourist visa). In addition, there are major infrastructure projects (2nd airport terminal, new cruise port, new metro line, new canal bridge, new event centre), which means that many new employees are looking for rented accommodation.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

FRAPAN-Invest obtains broker licence in Panama

There is a slow bureaucracy all over the world, including in Panama… After countless documentaries and references, our company “FRAPAN-Invest” has officially received the real estate agent license in Panama. This should make us the only German real estate company with its own broker license in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama